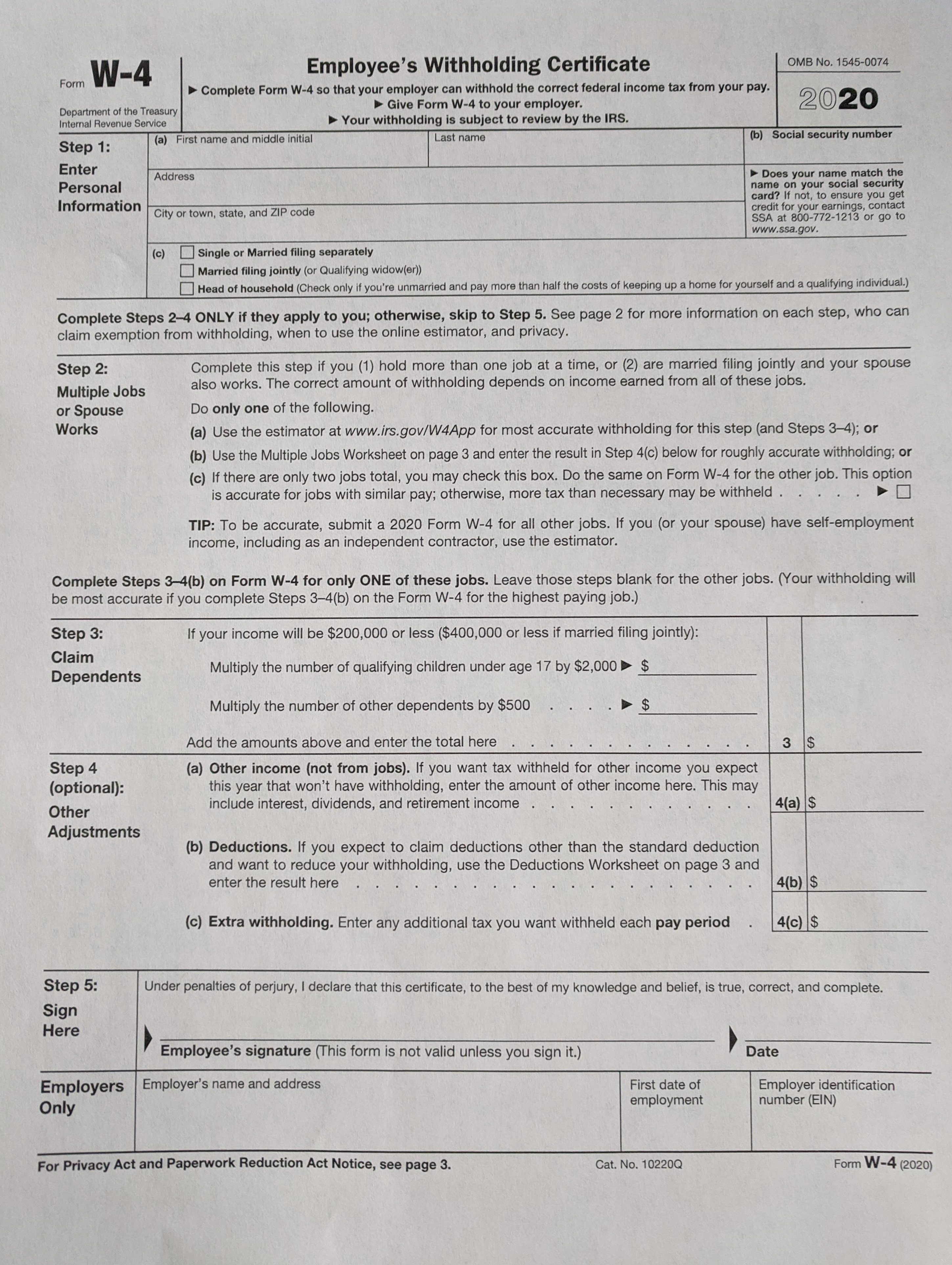

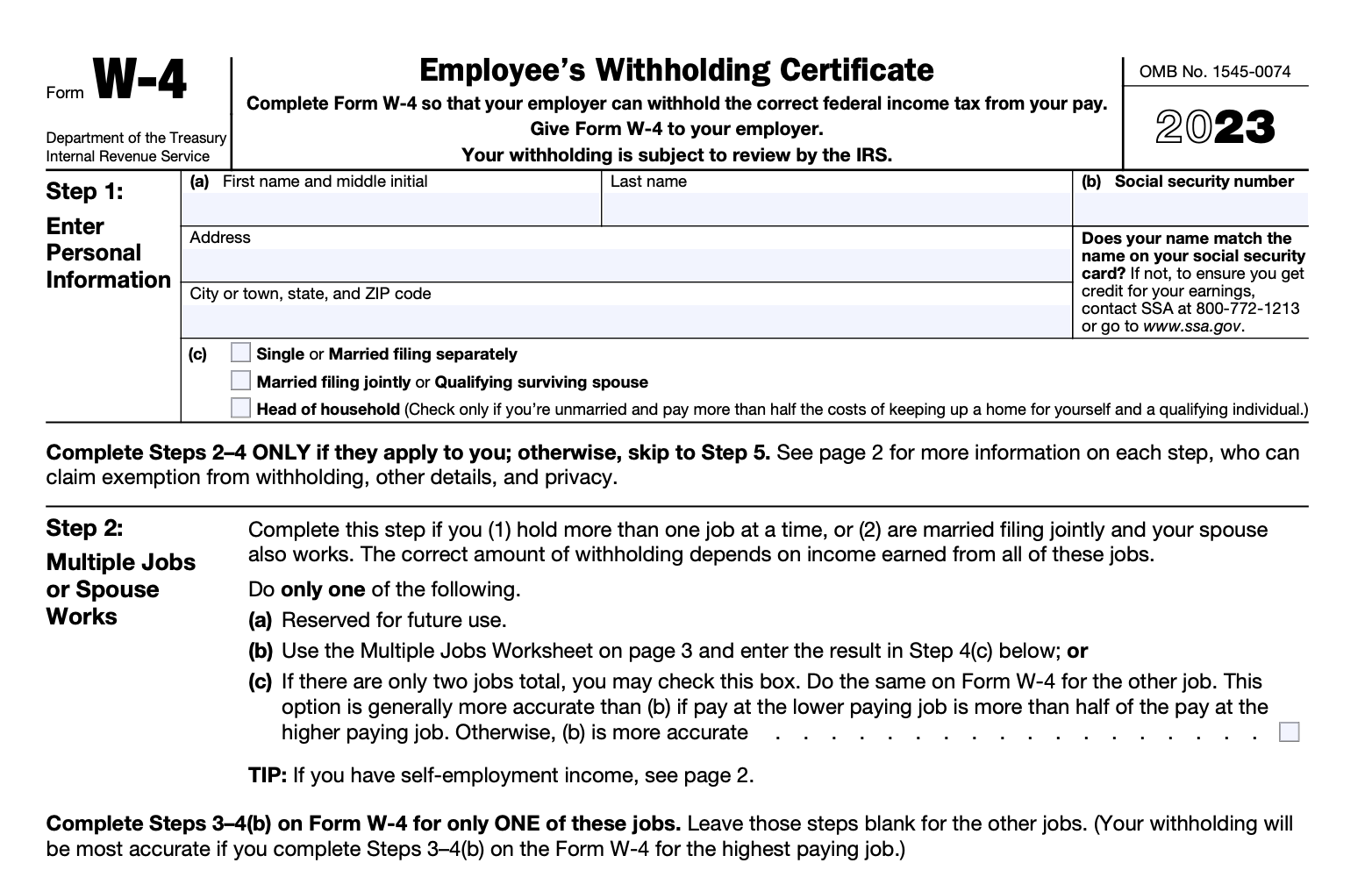

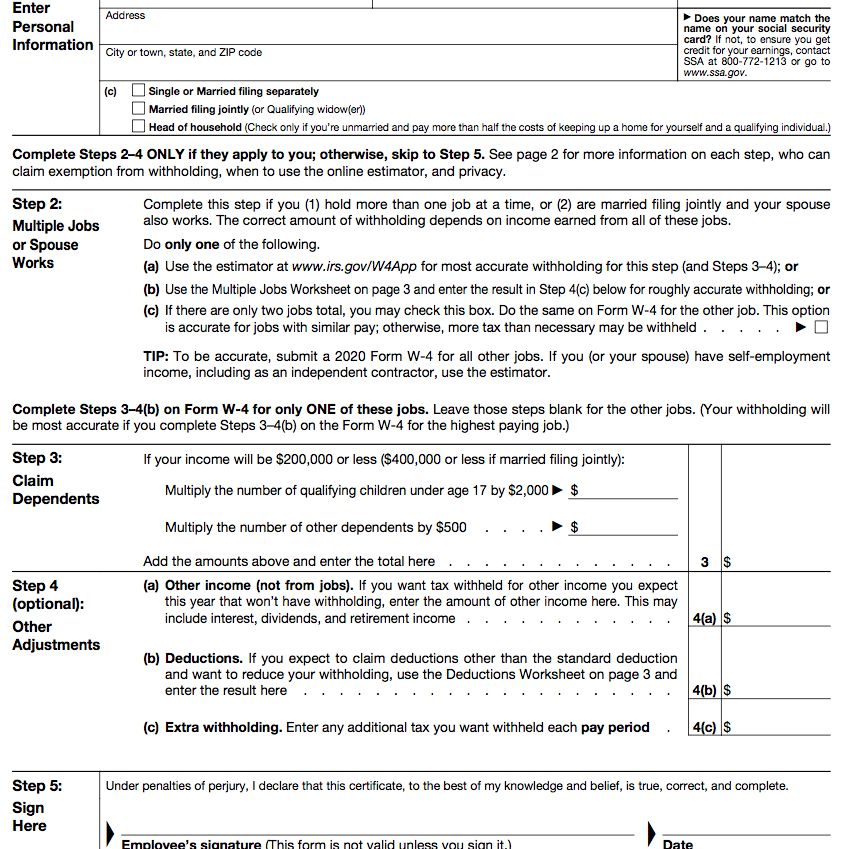

How To Fill Out W4 Married Filing Separately 2025

How To Fill Out W4 Married Filing Separately 2025. Both spouses will withhold taxes and claim deductions. This includes your legal name,.

When you’re married, the irs offers you two main filing status options — “married filing jointly” and “married filing. Taxes, insurance & investment tips.

Iowa Withholding Form 2025 Printable Forms Free Online, This includes your legal name,. You’ll also add your anticipated tax filing status:

What Is a W4 Form? How to Fill Out an Employee’s Withholding, Standard deductions for filing 2025 taxes in 2025: Fill in the sections for your name, address, and social security number.

When Can I File Colorado State Taxes 2025 Mandy Rozelle, You need to fill in your name, address, social security number, and filing status. First, you’ll fill out your personal information including your name, address, social security number, and tax filing status.

How To Fill Out The Most Complicated Tax Form You'll See At A New Job, The 2025 form is intended to be easier for employees to fill out and to accurately tell their employers how much federal income tax they want withheld from their pay. Enter “$21,900” if you are head of household.

What happens if 2 people claim the same child? Leia aqui How many, Fill out your name, address, and social security number. You will also want to determine your filing status and accurately fill this in.

How To Fill Out W4 Tax Form In 2025 Fast Updated Otosection, First, you’ll fill out your personal information including your name, address, social security number, and tax filing status. Here are the 2025 standard deduction amounts based on filing status:.

W4 2025 Printable il, The 2025 form is intended to be easier for employees to fill out and to accurately tell their employers how much federal income tax they want withheld from their pay. Fill out your name, address, and social security number.

Did the W4 Form Just Get More Complicated? GoCo.io, For married couples filing jointly: The portion of income not subject to tax for single taxpayers and married individuals filing separately is $13,850 for the 2025 tax year and $14,600 for the 2025.

4.3 Tax Forms The Math of Money, If you’re not sure yet, check out i’m married, what filing. Both spouses will withhold taxes and claim deductions.

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, The filing status options include single or married filing. Fill in the sections for your name, address, and social security number.